dependent care fsa rules 2021

How much can I contribute to my dependent care FSA. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

Dependent care FSA increase to 10500 annual limit for 2021.

. Employers can choose whether to adopt the increase or not. The most money in 2021 you can stash inside of a dependent-care FSA is 10500. Relaxed Rules for Health and Dependent Care Flexible Spending Arrangements Become.

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan. If you are divorced only the custodial parent may use a dependent-care FSA.

My employer allowed me to carry over the unused. Ive paid a 1000 for day care. Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022.

Ive contributed 3000 to dependent care FSA in 2020. September 17 2021. Allow employees to establish revoke or modify health or dependent care FSA contributions mid-plan year on a prospective basis during calendar year 2020 and 2.

Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. For Dependent Care FSAs you may contribute up to 5000 per year if you are married and filing a joint return or if you are a single parent.

If you want to make a change to your dependent care FSA elections please contact the OHR Benefits Department by submitting an inquiry online or by calling 833-852. Prior guidance provided flexibility to employers with cafeteria plans through the end of calendar year 2020 during which employers could permit employees to apply unused. The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly.

September 16 2021 by Kevin Haney. Health and dependent care FSA grace periods for plan years ending in 2020 andor 2021 may be extended for up to 12 months after the end of the plan year. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits.

It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or. Consolidated Appropriations Act 2021. Health and Dependent Care FSA Carryover.

With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. Your employer will also include in your wages shown in box 1 of your Form W-2 any dependent care benefits that exceed the maximum amount of dependent care benefits allowed to be. Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but.

Up to a 12-month grace period For FSAs with a. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing. Dependent Care FSA Increase Guidance.

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by. Consolidated Appropriations Act 2021. If you are married and filing separately you may.

For dependent care FSAs you may contribute up to the IRS maximum limit unless your employer has set a lower limit. The Dependent Care Tax Credit allowed taxpayers to claim up to 3000 of expenses for one dependent and up to 6000 in expenses for two or more dependents. ARPA Dependent Care FSA Increase Overview.

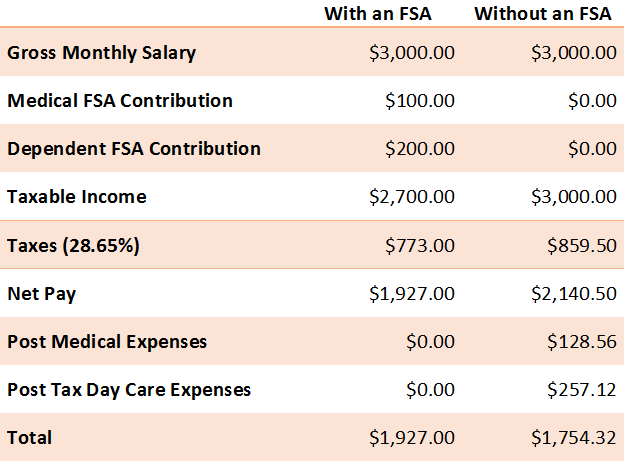

Dependent Care FSA roll over 2021. Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022. The money you contribute to a Dependent Care FSA is not subject to payroll taxes.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. This amount returns to.

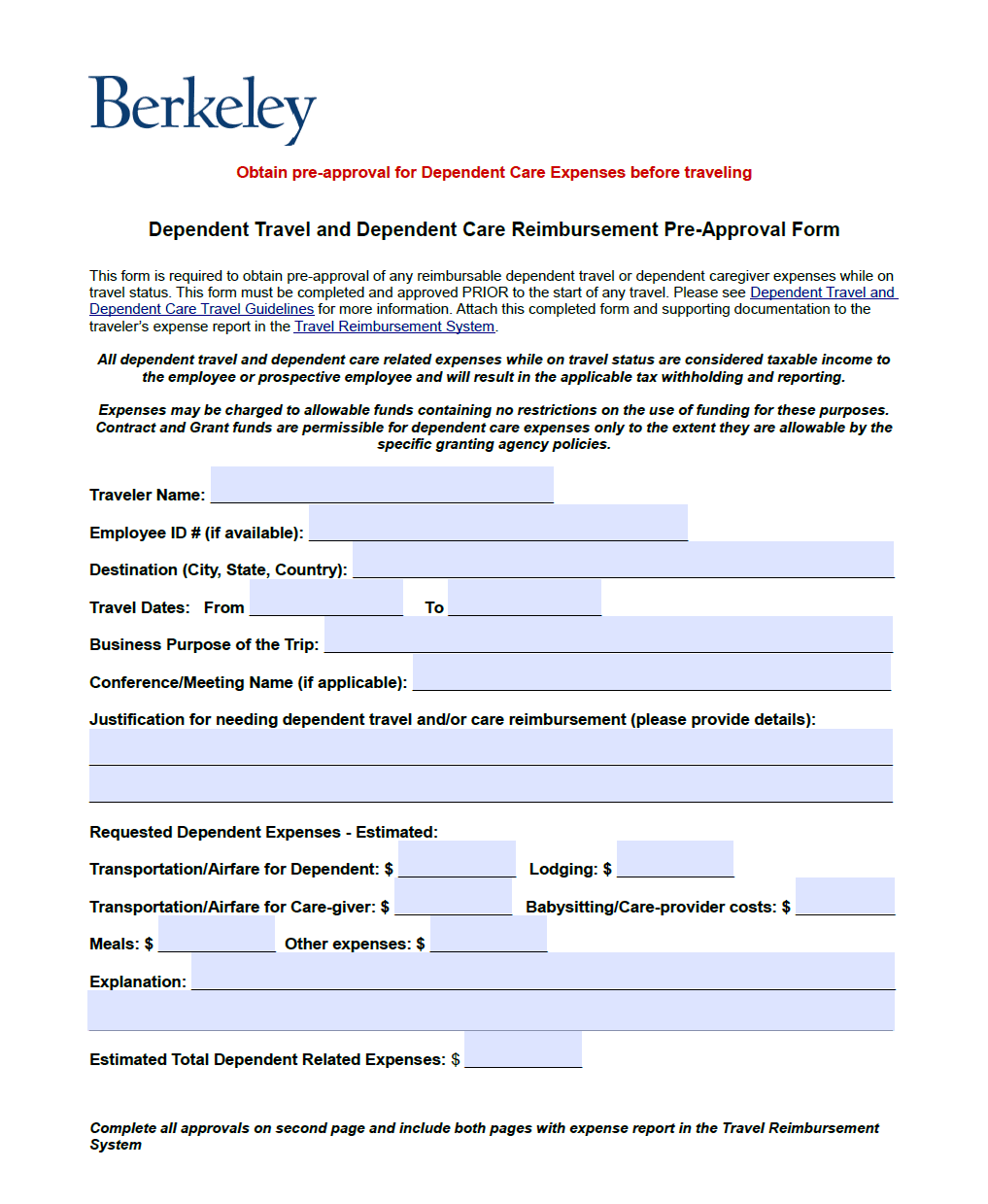

Dependent Travel And Dependent Care Travel Guidelines Berkeley Law

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Save On Taxes With Your University Benefits University Of Illinois

2021 Changes To Dcfsa Cdctc White Coat Investor

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

Ut Benefits Utbenefits Twitter

How The American Rescue Plan Act Of 2021 Impacts Dependent Care Assistance Programs Word On Benefits

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Changes To Dcfsa Cdctc White Coat Investor

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

How The American Rescue Plan Act Of 2021 Impacts Dependent Care Assistance Programs Word On Benefits

Hsa And Fsa Eligible Expenses For Mom Baby And Parents To Be